You hear it all the time, even from Japanese: “The Japanese are too risk-averse to be entrepreneurs. They prefer the security of a prestigious big firm rather than the satisfaction of striking out on their own.” If this were the whole story, how could policy measures stimulate more entrepreneurialism? Fortunately, the evidence shows it to be a gross exaggeration; there is a big difference whether culture explains, say, 80-90% of the problem, or “just” 30%-40%.

The reality is that Japanese face a far more adverse risk-reward ratio than do Americans or Europeans. Under the “lifetime employment” practices that stem—not from the 6th century—but from top-down changes introduced after World War I and World War II, someone leaving a good job at a big firm for a startup has little chance of ever being hired at another top firm. Firms who invest in training workers do not want them to take that knowledge elsewhere and so they’ve created an informal “no-poaching” pact among themselves.

Beyond this, the consequences of bankruptcy are quite harsh in Japan. And even if a startup does succeed, the weak capital markets do not make the entrepreneur as rich as his American counterpart. The proverbial Japanese mother reluctant to have her daughter marry an entrepreneur has a realistic sense of the stumbling blocks he faces.

On the other hand, consider my cousin, who was working at Hewlett-Packard during the dot.com boom. His boss, who had developed a server that had four times the capacity but generated no more heat, wanted to start a new firm and take my cousin with him. If they succeeded, they’d be millionaires. On the other hand, HP offered to buy around 10-15% of the new firm and promised that, if their firm failed, they could get their old jobs back. Needless to say, his mother-in-law was delighted.

Attitudes reflect on-the-ground realities

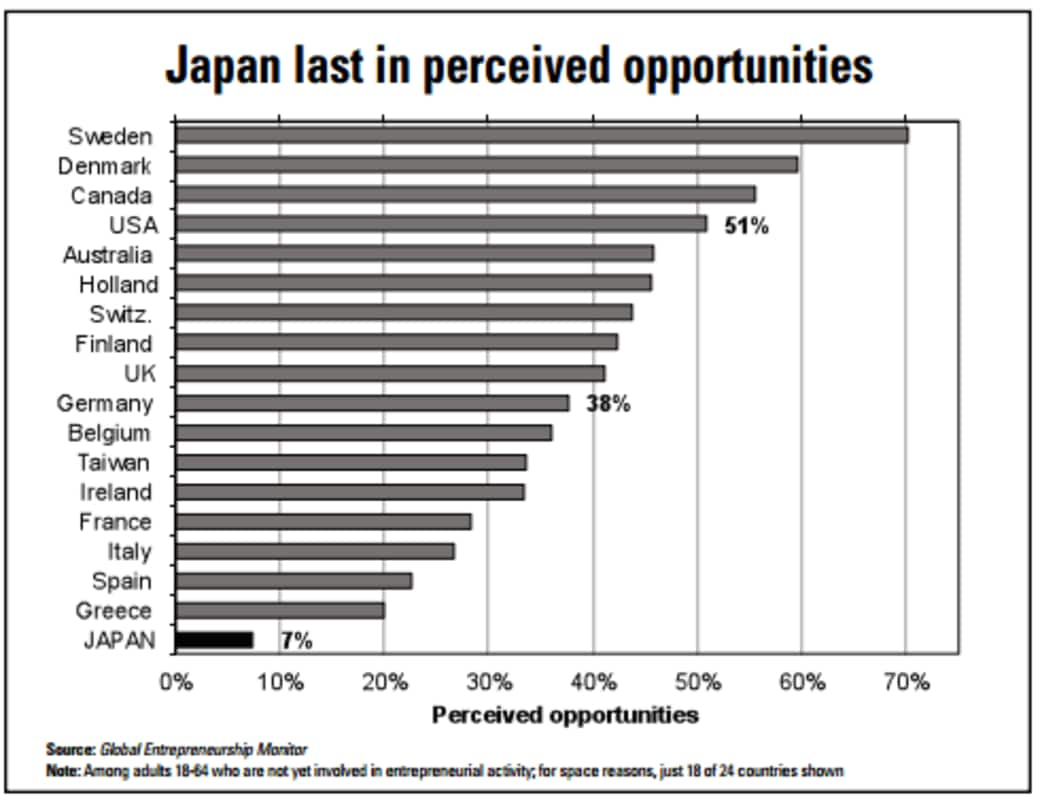

In 2014, as in virtually every year, Japan came in last among 24 innovation-driven economies in the Global Entrepreneurship Monitor (GEM) survey. Just 3.8% of adults 18-64 are engaged in starting a firm, compared to 5.3% in Germany, and a 24 country average of 8%. Japan also comes in at or near the bottom in several attitudes that correlate well with activity:

• Only 7% of Japanese not yet involved in startups see good opportunities in Japan; the average is 37% (see figure 1).

• Only 12% of Japanese adults not yet involved in startups see themselves having the capabilities to run their own business vs. a 24-country average of 40%.

• With one exception, Japan has the most people dissuaded by “fear of failure,” with 55% of adults not yet involved in startups citing this.

To a large degree, these attitudes reflect a realistic perception. All over the world, most entrepreneurs fail; but the consequences of failure are often bigger in Japan. In Japan, as in many countries, the owner of a small business taking out a bank loan must sign a personal guarantee so that he is personally liable if the business fails.

Masahiro Ito—who started his first firm as age 17, saw a business fail, and is now CEO for engineering at the highly successful Start Today—noted that, even if the owner of a business sells off 80% of his business to investing partners, he is still liable for the entire 100% of the loan.

Combine this with the great difficulty of a bankrupt to get credit in the future, and entrepreneurs get one roll of the dice. By contrast, in Silicon Valley, the mantra is that, if you’ve not failed at least 2-3 times, you’ve not tried hard enough. Ito said finding a way to lighten the load of the personal guarantee system would stimulate many more attempts at business formation.

Anti-competitive practices

There is also the reality of anti-competitive practices by entrenched incumbent firms against challengers. For example, we were told by Hitomi Tokuda, head of the Japan Entrepreneurs and Presidents Association, about a startup that developed a portable medical device that would be very useful in accidents.

The firm had difficulty acquiring patents in Japan, where, as in Europe and now in the US, the patent goes, not to the person or firm that first invents a device, but to the one who first files. By using various tactics to delay the startup’s patent filing, incumbent device-makers thwarted it. So, the startup acquired patents in other countries, and started by marketing overseas.

Note the contrast in Germany, where we met with Bartosz Kosmecki, the CEO of Berlin-based Scopis. This firm developed a surgical navigation system for delicate procedures, like brain surgery; it guides surgeons’ endoscopes using software called “augmented reality.” This greatly simplifies a very intricate procedure, by giving the surgeon a clearer view. Although the firm is only six years old, its products are sold in 50 countries. Kosmecki told us that his firm’s efforts got none of the patent obstruction that we had been told about in Japan.

We got a similar impression from our talk in Berlin with Kay Balster of the venture fund, High-Tech Gründerfonds, and Joachim Rautter of Peppermint Ventures. The Gründerfonds provided €500,000 ($560,000) in seed money for a startup called Humedics, a spinoff of the Free University of Berlin and the Charité University Hospital.

Humedics developed a better test (called LiMAx) for liver enzymes, which will provide better risk assessment and results for liver cancer surgery. Peppermint is part of a consortium that later provided €6 million ($6.05 million) in growth capital. Neither mentioned obstruction from larger firms.

If the Japanese government wants more entrepreneurs, it has to enforce the Anti-Monopoly Law and make sure that the patent process is fair.

Japan is only just getting off the ground in creating the kind of university training for would-be entrepreneurs that the US has seen for decades. In an OECD survey about entrepreneurial education, Japan came in last. Only 20% of respondents said that their schools had given them the skills and attitudes necessary to run a business, compared to a 43% average among 24 countries in the OECD. Just 18% of Japanese said that their education helped instill a sense of initiative, compared to 54% in Germany.

Some of the top universities in Japan are trying to remedy the situation. Waseda University pioneered the Waseda Entrepreneurship Research Unit (WERU), which began offering courses in 1995. Professors Tadashi Takiguchi and Hironori Higashide have also created a venture capital fund called WERU INVESTMENTS.

These professors reported a bifurcation among college-age students. On the one hand, a small, but growing, fraction flocks to the WERU courses. However, a much larger fraction is becoming even more risk-averse due to the impact of the long economic stagnation.

A closer look at the GEM report shows information that gives hope for remedies. Relative to the high obstacles on both the side of capabilities and opportunities, entrepreneurial activity in Japan is surprisingly high, even though it’s abysmal on absolute terms. GEM wrote: “If we take into account entrepreneurial attitudes, Japan’s level of entrepreneurial activity actually exceeds that of the United States. For example, 19.5% of Japanese adults who believe they have the ability to start up a business are actually doing so; in the USA, the figure is 17.4%.”

What this suggests is that, if Japan can improve the capabilities of potential entrepreneurs via the educational system; if it can use policy intervention to improve the genuine opportunities for startups to grow and to reduce the harshness of penalties for failure, then the frequency of high-growth startups should increase. To be sure, that’s easier said than done.

Make Japan safe for “disruptors”

The majority of true “gazelles,” i.e., high-growth small and medium firms, are almost inherently disruptive. Most grow by delivering a better version of a good or service than is being provided by incumbent firms and/or they deliver it more cheaply. That forces incumbents to downsize or even shut down. Disruption is another word for “creative destruction.” Any economy needs a balance between stability and disruption, but Japan’s post-1973 political economy has moved too far toward the pursuit of stability.

Tällt Ventures, a UK-based consultancy firm, puts out a “Disrupt 100” list every two years. In its latest edition, only two Japanese firms made the list. One is Spiber, which came in first out of all 100. Founded in 2007, Spiber produces a synthetic material out of fibroin protein that is modeled after spider silk. If it succeeds, it would be revolutionary in needing no petrochemicals. It is notable that Spiber has international backup, an alliance with the US-based The North Face in producing the outer fabric of a parka.

As of 2015, Spiber had $2.5 million in sales, 100 employees, and had raised $130 million in funding. Its core funders are primarily Goldwin (a Japanese firm which markets North Face products in Japan) and secondarily, JAFCO, Japan’s oldest venture capital firm, and Keio University. Founder Kazuhide Sekiyama, now just 33 years old, spun-off Spiber from Keio’s Institute for Advanced Biosciences when he was a graduate student there.

Many fail to realize how strange it is for Japan to have so few “disruptors.” Not so long ago, Japan was the home for global disruptors. Consider Sony, whose transistor radio in the 1950s not only toppled vacuum tube-based devices, but, because it freed the radio from an electric outlet, let teenagers listen to Elvis without their parents being able to stop them.

Sony was hardly unique. During Japan’s high-growth era (1950-73), Japanese firms were first in the world to either invent, or to introduce on a mass basis, new products and processes, from VCRs to oil supertankers, from continuous casting and electric arc furnaces for steel to solid-state TVs and the Toyota production system.

Unfortunately, in response to the abrupt economic slowdown that followed the two oil shocks of the 1970s, Japan shifted from promoting future winners to protecting those who lost out from rapid structural shift, and, in many cases, even slowing that shift. And so, part of what is portrayed as a cultural desire for stability is actually a rationalization for post-1973 dysfunctional policies.

“Schizy” government policy

The tension between a genuine desire for more entrepreneurialism and political pressure to protect incumbent firms lies behind the failure of four decades of Japanese government efforts. It’s as if Tokyo tried to nurture non disruptive entrepreneurialism.

There is no little question in our mind that the Japanese government, particularly the Ministry of Economy, Trade and Industry (METI)—has been sincere in their efforts. These include: the “Technopolis” plan of the 1980s: government financing of startups; promotion of stock market efforts like Mothers for more IPOs (Initial Public Offerings); reduction of minimal capital costs to form Limited Liability Corporations; reforms in M&A laws; efforts to promote venture funds, etc.

Governments all over the world are finding that there is no magic recipe. But, in Japan, there is the added problem that efforts to promote new startups are dwarfed by efforts that, deliberately or not, serve to protect incumbents. What the right hand gives, the left hand takes away.

For one thing, Japan ranks a stunning 81st on the World Bank rankings regarding the ease of starting a business, placing 121st regarding taxes, 79th on getting credit, and 51st on enforcing contracts.

The government-affiliated Japan Finance Corporation has provided loans to 100,000 Small and Medium Enterprises (SMEs), averaging about 7 million yen ($70,000), mostly without a requirement for collateral, guarantors or personal guarantees. 23,000 of these went to startups with an average of four employees each. In the effort to promote innovative firms, it has collaborative agreements with about 46 universities, another device seen across rich countries. In fiscal 2010, in the midst of the economic crisis, JFC’s new loans added up to 2.4% of GDP; in fiscal 2013, they were down to half of that.

Unfortunately, according to William Saito, a well-regarded entrepreneur who serves as Special Advisor to the Cabinet Office, there is little effort to screen these applications to promote the most promising firms. “The people who get this money are those who are mainly good at filling out forms. There are even some companies that help people fill out the forms.” We heard similar comments from many people.

At the same time, the JFC and affiliated Credit Guarantee Corporations provide government guarantees for loans. The credit guarantees add up to almost 6% of GDP each year—more than any other rich country except for Greece—and they aid about 40% of all SMEs in Japan. Without these loan guarantees, these SMEs might not be able to get loans from the banks.

A properly-run credit guarantee program might be helpful in promoting startups, given banks’ reliance on collateral that startups often lack. Unfortunately, research by economists like Kuniyoshi Saito and Daisuke Tsuruta suggests that, whatever good these programs do, they also keep alive underperforming firms that ought to exit the market. The harder it is for zombies to die, the harder it is for potential gazelles to be born.

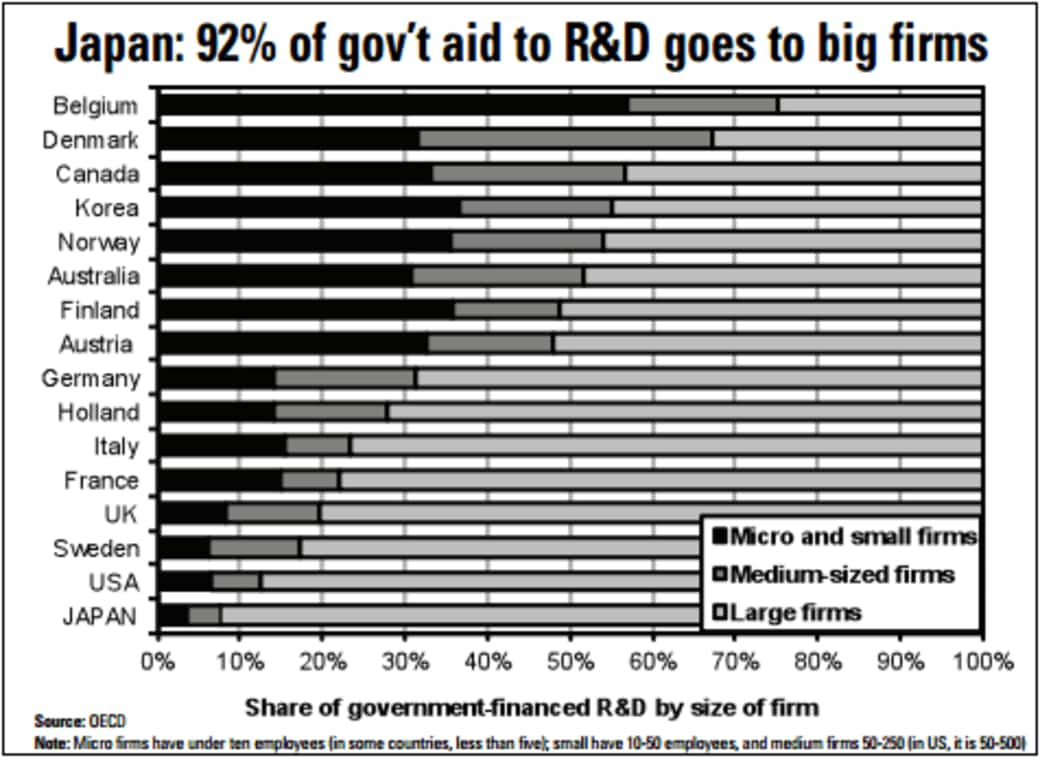

Like most other rich countries, Japan provides aid to company R&D. In fact, as a share of GDP, Japan comes in sixth out of 25 OECD countries in giving the most aid, about 0.15% of GDP. The bad news is that 92% of Japan’s aid to R&D goes to large firms, by far the highest share among 27 rich countries in the OECD. Potential gazelles, those most in need of such aid, get very little.

It is a situation that could be easily remedied if the political will were there. Japan could provide most of its aid via direct subsidies to worthy firms, as do most OECD countries. Instead, it provides 80% of its aid via a tax credit for company money spent on R&D. However, the tax credit only helps firms already earning profits, like old, established firms. It doesn’t provide help for new firms, some of which are potential gazelles not yet earning profits.

Does capital flow to the innovators?

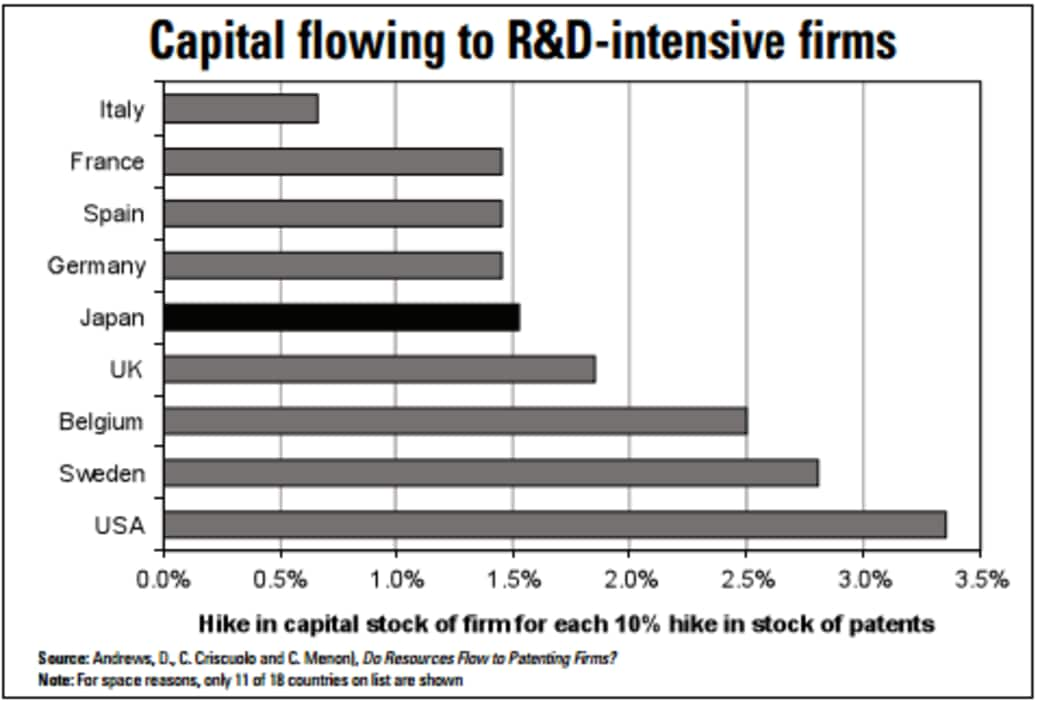

One test of a country’s ability to promote the growth of innovative firms is seeing how much of the country’s capital investment flows to these firms. Three OECD economists looked at nine countries to see how much the capital stock—i.e., factories, offices, equipment, etc.—at the average patenting firm in each country grew as a result of a 10% increase in the stock patents.

The US came in first. A 10% increase in the stock of patents at an innovative firm led to a 3.2% increase in that firm’s capital stock. Japan was in the middle of the pack with just a 1.5% hike in capital stock. Germany was just behind Japan. So, in the US, twice as much capital flowed to patenting firms as in Japan and Germany, and four times as much as in Italy.

One reason, reports the OECD, is that Japan suffers from many structural rigidities that end up impeding a transfer of capital from old, incumbent firms to gazelles on the rise. These include: stringent employment protection; cumbersome product market regulations; overly harsh bankruptcy practices that increase the penalty for failure; and underdeveloped capital markets.

Even with the best of will, Japan is not going to cure its structural defects overnight. But there are some eminently doable steps that could make a big difference relatively soon.

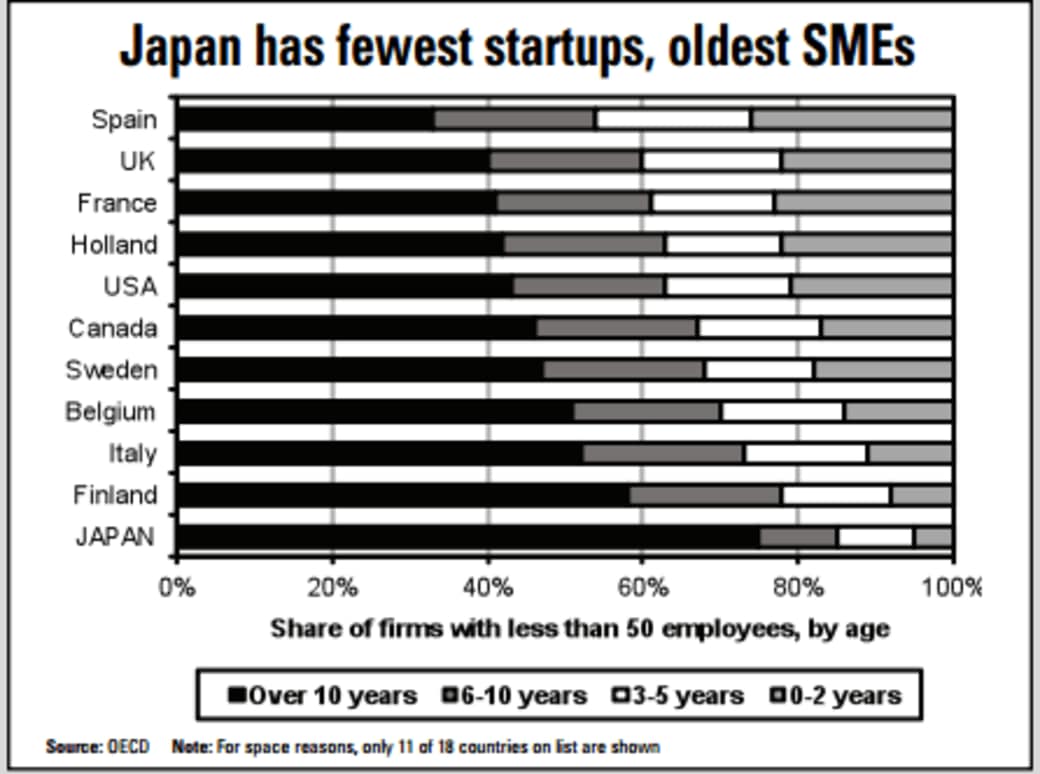

When we asked Japanese entrepreneurs what Tokyo could do that would make a big difference, Jeffrey Char, a serial entrepreneur in Tokyo who founded J Seed, offered a simple, but profound concept: focus aid on younger rather than smaller firms. Japan spends a lot of money providing all sorts of aid to small and medium enterprises (SMEs). But most of these will never be gazelles.

There may be reasons to help SMEs in general, but that has nothing to do with promoting gazelles. This is particularly a problem in Japan because it has the fewest startups among its SMEs (just 5%) and the most older firms, i.e., those over age 10 (75%).

For example, suggested Char, Japan could set aside 5-10% of its huge procurement budget (20% of GDP), not for a quota, but for a preference. If a firm under five or ten years old and an older firm can provide equal quality at equal price, then award the contract to the younger firm. That would give the younger firm, not just vital cash flow, but an enhanced reputation to attract customers in the private sector. It could also help it secure more private sector financing. This simple step does not require fixing all of the structural obstacles. All it requires is political will.

A second step, based on OECD research, relates to R&D. First, shift more of government aid from tax credits to direct grants and cheap loans. Germany, for example, provides grants that fund up to 50% of R&D for firms that meet certain standards. Secondly, for the tax credit portion, install a carryforward provision so a would-be gazelle that is not yet profitable can offset its future profits.

The US and Canada offer 20-year carryforwards for R&D tax credit; in the US, the carryforward is unlimited. Unfortunately, in 2015, the Abe administration went in the opposite direction, eliminating altogether its previous 1-year carryforward.