Japanese companies have a long-standing, stellar reputation regarding their research and development capabilities. Major materials manufacturer Toray Industries continues to boast a world-leading position in the field of product development, and electronics companies, such as Hitachi and Panasonic, have been making a comeback despite being temporarily surpassed by their South Korean rivals. We took a closer look at the current R&D approaches at these companies.

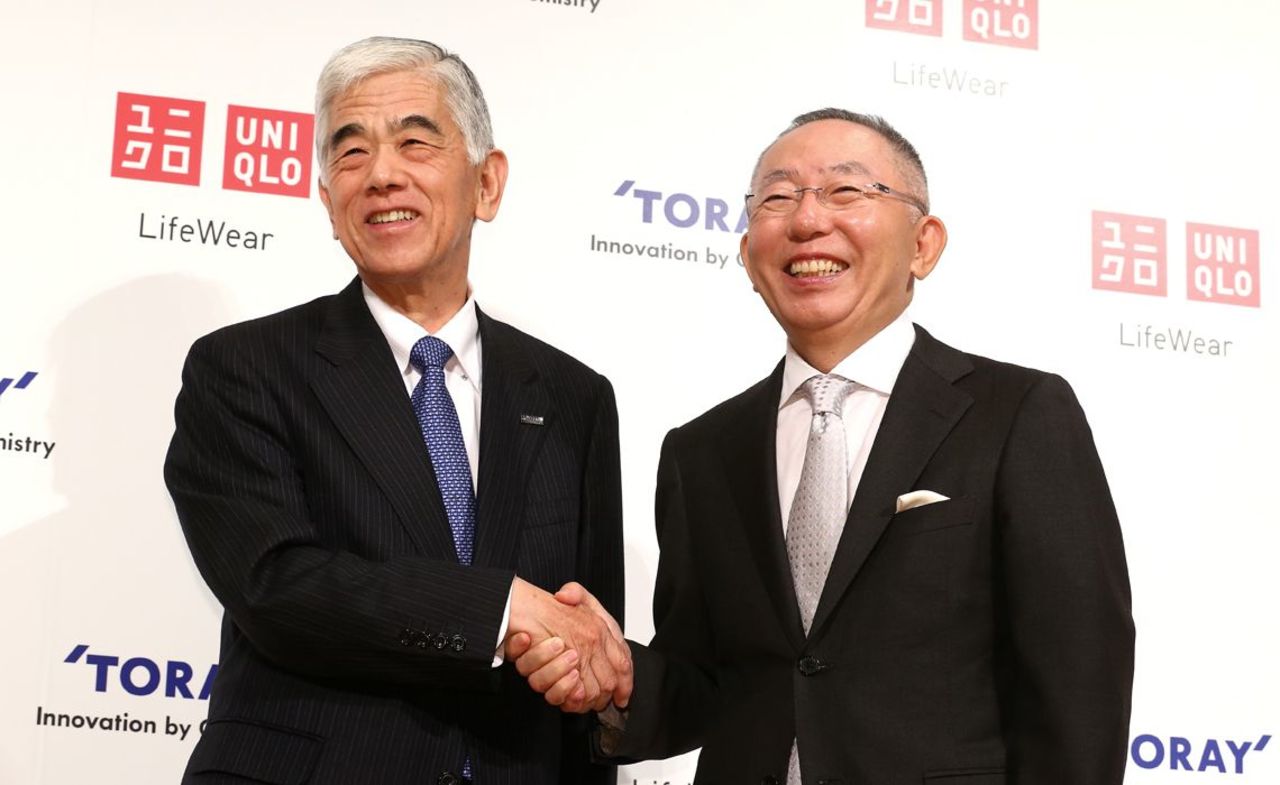

Toray’s lightweight, durable carbon fibers designed for aircraft, reverse-osmosis membranes used in seawater desalinization, and other unique materials have found applications in Uniqlo’s ubiquitous Heattech brand of innerwear. Toray's Technology Center, the nerve center of Toray’s R&D operations, is home to numerous specialists who collaborate with various in-house divisions to produce distinctive products such as these.

Toray is also known for a management style that focuses on the long term. Until the company reached the point where carbon fibers could be fully deployed in aircraft applications—the original intention for these materials—applications in other products, such as fishing poles, and tennis rackets, helped to keep the project up and running. This tireless, sustained pursuit of projects with an eye toward eventual marketability is what ultimately leads to success at Toray.

Electronics companies throughout Japan, who tend to cut their R&D budgets every time a corporate crisis occurs and thus fall behind the technological advancements of competitors in countries such as South Korea and China, have provided Toray with many examples of what not to do.

The company's R&D efforts are run by 3,700 personnel on an annual budget of 63 billion yen ($588 million). In the past decade, this budget was only reduced once during the year following the massive economic downturn brought about by the bankruptcy of Lehman Brothers; other than that single year, the budget has seen steady annual increases.

"If we were to focus on the short term and cut the R&D budget in order to achieve short-term profits, it would benefit us for the time being but diminish our future potential,” explains Koichi Abe, who serves as chief technology officer at the Technology Center and Toray executive vice president.

The company plans to open their new research center, the Future Innovation Research Center, in Otsu City, Shiga Prefecture in 2019. The facility will develop new materials utilizing macromolecular technologies, pursue efforts in the medical field, explore new forms of energy, and undertake a diverse range of other cutting-edge research. With a 10 billion yen price tag, the center represents Toray's largest-ever research facility investment.

Hitachi’s efforts

In April of last year, Hitachi implemented some major changes to their R&D framework. This involved reorganization of the research facilities owned by the corporation and eliminating the approach of placing each facility in charge of a separate technological field.

"The era of creating technologies at research centers and commercializing them at corporate business divisions has come to an end," says Norihiro Suzuki, CTO, research director and executive officer. He explains that each Hitachi engineer is expected to take into consideration profitability while offering innovative solutions. The company's current annual R&D expenses come in at 350 billion yen ($3.2 billion).

Hitachi's reorganization measures relocated 500 of the company's 2,600 R&D personnel to their Global Center for Social Innovation, part of an international network of facilities. The center strives to identify customers’ needs and to present new solutions in response. For example, when a railway company is pursuing a subway line construction project, the center assists with issues related to tunnel and track-laying work while also addressing less tangible issues, such as financial proposals, to help keep the client company profitable.

Hitachi has numerous connections in their various business fields, and these are accompanied by a rich array of knowledge and experience. Formerly, the company's accomplishments were recorded in Japanese only by individual staff members; in one year's time, however, all these data have been rewritten in English, making it possible to search the database and identify which technologies were used in which products and then immediately offer relevant proposals to overseas customers.

Suzuki says the company hopes to "triple our current speed" with the goal of achieving rapid responses on par with those of Silicon Valley.

Scouting a new leader from outside

In contrast, Panasonic has turned to an outsider for their key research division in hopes that this fresh face would re-energize operations. Kazuhiro Tsuga has pursued continual company reforms since his appointment as president in 2012, and these latest changes to the R&D framework strongly reflect his style.

In October 2014, the Head Office Research Division was reorganized as the Advanced Research Division, and Panasonic recruited Kuniaki Tatsumi of the Japanese government's National Institute of Advanced Industrial Science and Technology to serve as the new division's director.

"The organization lacked sufficient freedom and openness when it came to expressing opinions on the company's policies and direction,” says Tatsumi. To rectify this, he promoted open debate in which "nothing is considered taboo" as part of his focus on fostering a work environment in which young employees could more actively make suggestions.

The Advanced Research Division's mission to embark on novel, never-before-seen projects and pursuits is one of the major reasons behind Tatsumi's reforms of Panasonic's corporate climate.

The company spends 450 billion yen ($4.2 billion) annually on R&D, and even though they have long served as leaders in the digital home appliances market, they sense the need to move into new fields as the next stage of their corporate development, with the greatest emphasis being placed on the Internet of Things (IoT) and robotics. Moreover, Panasonic plans to increase their efforts regarding recruitment and utilization of human resources from outside the company.