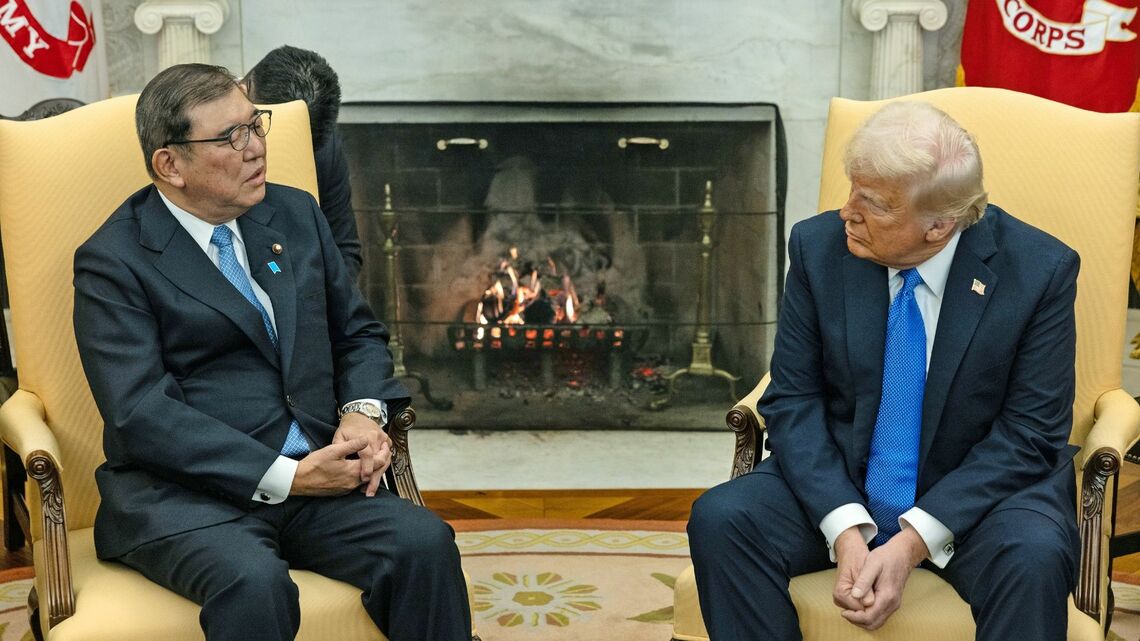

Tokyo’s “don’t poke the beast” approach to Donald Trump’s trade war was foreshadowed by Prime Minister Shigeru Ishiba’s preemptive concessions on Nippon Steel (NS) during his February 7th summit with Trump. According to several sources, before Ishiba even stepped on the plane, Tokyo had decided on his message to Trump: he supported the notion of Nippon Steel simply investing in US Steel rather than buying. While Tokyo informed NS of the decision in advance, NS disagrees and is still pushing for a 100% buyout. Washington was not informed in advance.

It is not clear whether or not Ishiba told Trump that Nippon Steel had agreed or left that ambiguous. In any case, at their post-summit press conference, Trump claimed that NS had agreed, which is untrue. Either Trump heard what he wanted to hear, or he made it up. In any case, Trump declared, “Nissan [referring to Nippon Steel] is going to be doing something very exciting.... they’ve agreed to invest heavily in US Steel as opposed to own it.” Ishiba could have refrained from correcting Trump in the name of diplomacy. Instead, he endorsed the statement, saying, “As Mr. President says, it is not acquisition; it is investment.”

Ishiba did get Washington to agree to let a senior NS executive meet with Commerce Secretary Howard Lutnick (NS wanted Trump himself) and called that a step forward. NS was grateful for that, according to a source familiar with its thinking. However, said Ishiba, it’s up to NS to negotiate the equity share (i.e., whether it’s 100%, a majority less than 100%, or even a minority share, which deprives it of control). NS, for its part, is not following government guidance. Rather, it will use the merger agreement as the starting point for any discussion, a non-starter in Washington.

Steel Vs. Autos

Why did Ishiba undercut Nippon Steel to placate Trump? For one thing, with the Liberal Democratic Party (LDP) facing elections this summer and Ishiba doing poorly in the polls, he needed to have the summit look like a success. Disagreeing with Trump on a well-known issue can be a recipe for failure, as President Volodymyr Zelensky found out.

Indeed, when Ishiba was being prepped for the summit, explained reliable sources, he was advised: don’t disagree with Trump; speak in short passages; don’t use logic on him; talk about how Japanese investment benefits America. Speaking on Japanese TV after his return, Ishiba said that Trump was adamant that any NS investment in US Steel be less than 50%. “If I had immediately rejected that from the outset, the negotiation would have just fallen apart, so I decided not to do so.”

The second consideration is Japan’s economic priorities. This is my surmise rather than something sources told me. While calling Nippon Steel a “national security threat” to the US is very important, its economic consequences for Japan are dwarfed by the 25% tariffs Trump says he will impose on all imports from any country of autos, computer chips, and pharmaceuticals. Japan’s domestic motor vehicle and parts shipments account for 20% of all manufacturing shipments. 20% of all Japanese exports, and a whopping 40% of its total exports to the US. At a time when Japanese automakers are suffering big drops in market share throughout Asia, a substantial loss in sales to North America would be a disaster for Japan. By contrast, steel provides just 1% of Japan’s exports to the US. Also, the number of Nippon Steel employees is only in one-eighth of the number of automotive workers.

So, how will Tokyo deal with Trump’s trade war? It could join with other nations in Trump’s line of fire. Instead, explained an informed source, Japan is going it alone with a “low profile” approach. It will seek an exemption from such tariffs regardless of what Trump does to other countries. Yoji Muto, the Minister of Economy, Trade and Industry (METI), is arranging a trip to Washington to request such exemptions. (Of course, Japan’s exports to tariff-hit countries like China and Mexico will be greatly hurt even if Japan itself is exempted.)

One does not get exemptions from Trump by confronting him or by arguing economic rationalities. Instead, one offers gifts that increase his power by making him look better in the eyes of his voter base. That’s why Ishiba backtracked on the steel merger and told Trump that Tokyo wants Japanese direct investment in the US business sector to rise from $783 billion at the end of 2023 to $1 trillion. Trump also asked Japan to buy more fossil fuel imports from the US instead of other countries. Of course, private companies have to make these decisions, and Ishiba cannot force them. Still, speaking in the tones of a petitioner helps Trump boost the “tough guy” image he prizes.

Can Nippon Steel Change Trump’s Mind?

Nippon Steel cannot buy US Steel (USS) without Trump’s approval. Moreover, if NS acquiesces to only a minority interest, the deal may fall through for legal reasons. Since the original agreement required the approval of USS shareholders, such a material change in the terms would most likely require another USS shareholder vote. It may be hard to get approval for inferior terms.

How could NS induce Trump to change his mind? While Trump has reversed himself on occasion, he did so only when it benefitted him and did not involve his core beliefs. Many blue-collar voters in the Midwest industrial states—but not the workers in the steel plants—have bought into the opposition to NS as a nationalist issue. Reversing himself could erode his support.

What could NS offer Trump to change his mind? When I asked a source familiar with NS’ thinking, he contended that “everything with Trump is transactional.” In other words, he has few core beliefs and, thus, will relent if additional NS concessions allow him to brag: “The previous deal was a bad deal; I got US Steel a good deal.” In NS’s view, the answer is security guarantees that put Americans in charge of issues like whether to lay off workers, close down plants, or whether the merged company will support Trump on import tariffs.

While I agree that there are few things Trump really believes in aside from his own power, money, and ego, I think he truly is a rabid nationalist, protectionist, and isolationist. I doubt these concessions will do the trick, but with Trump, one never knows.

The process will begin with a meeting between Secretary Lutnick and a senior NS executive, probably Executive Vice President Takahiro Mori. NS hopes he will try to persuade Trump that it’s a good deal and secure a meeting with Trump himself for NS CEO Eiji Hashimoto.

What Will NS Ask Trump To Approve?

NS wants Trump to approve the original merger deal. NS would buy 100% of US Steel at $55 per share for a total of $15 billion. Plus, it will inject at least $2.6 billion into modernization and decarbonization technology in USS’s backward blast furnaces, and it won’t shut down existing blast furnaces for an unclear period of time.

There might be some conditions under which Nippon Steel would accept a controlling share of less than 100%. However, if NS can only buy 75% of the shares, they’re not worth $55. And should NS accept less than 51%, their value is much, much less. However, asking US Steel to accept less than $55 would violate the existing contract.

Unless the two companies and the Trump administration agree by June 15th, then, under the ruling by the Biden Administration, the merger will be terminated. While an extension is legally possible, it would take an agreement by all three parties. So, an extension is highly unlikely unless the parties are getting close to an agreement.

It’s going to be an uphill climb for Nippon Steel.