Japan’s economy is in for a big “Trump Shock” if Donald Trump returns to the White House. Delicate global supply chains and demand for Japanese exports will both be seriously disrupted by his plan to impose an across-the-board 10% tariff on all imports and 60% on imports from China.

At the same time, Trump’s inflationary policies— additional big tax cuts and tariffs—will compel the Federal Reserve to impose higher interest rates than it now intends. That, in turn, will put downward pressure on the yen.

How big a shock depends on how much of Trump’s talk would become reality. Moreover, Joe Biden’s departure makes the election outcome uncertain.

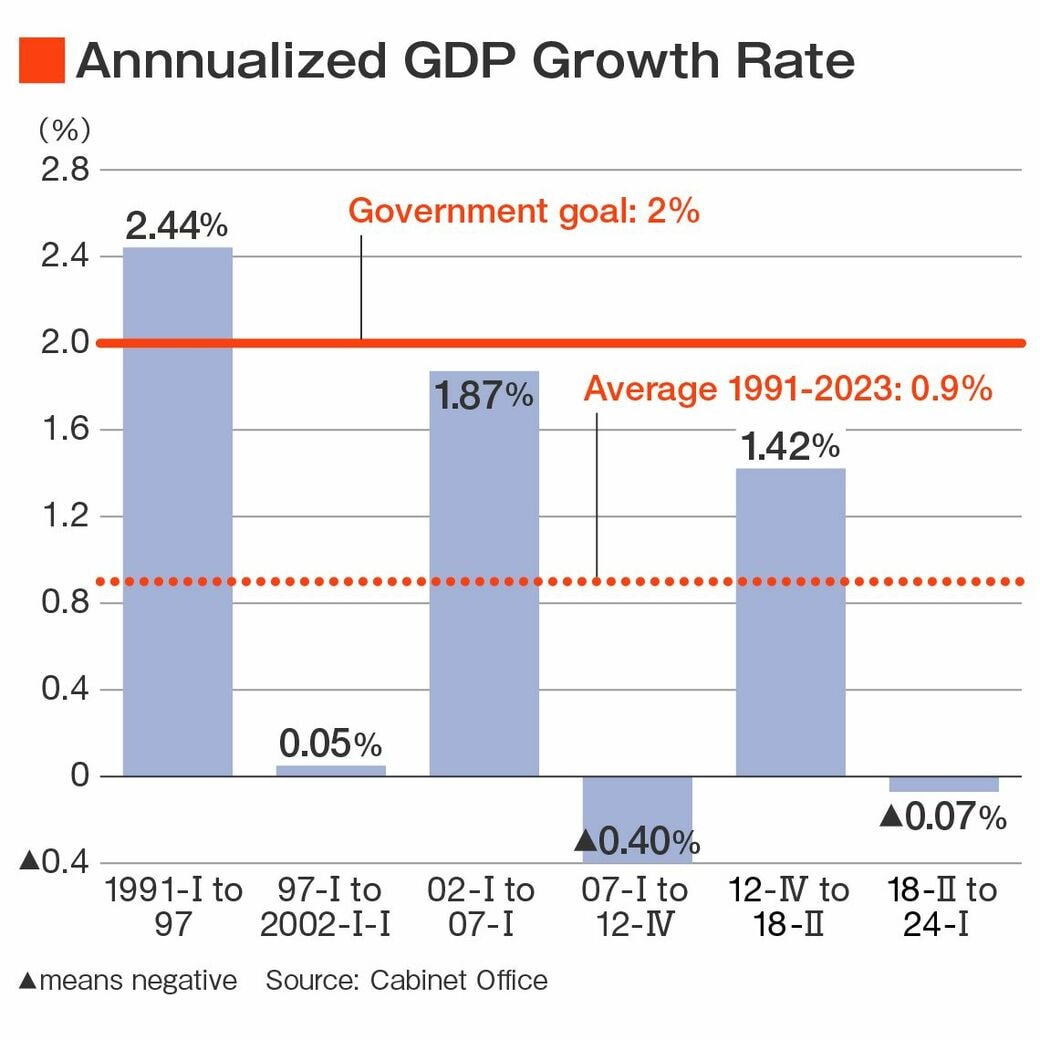

But here’s what we know. Japan has a very brittle economy that overreacts to external shocks, sometimes even more than to purely domestic shocks like the March 2011 catastrophe. As a result, Japan has suffered stop-go growth for the past three decades.

In the 1990s, the impact of Japan’s internal banking crisis and consumption tax hike was greatly exacerbated by the 1997-99 Asian financial crisis. It took GDP five years to return to the level of early 1997.

A decade later, the global financial crisis triggered another five-year bout of negative growth even though Japanese banks did not participate in the malpractices that caused the crisis.

Finally, while Japan suffered less than others from COVID-19 and Russia’s invasion of Ukraine, these events wreaked havoc in a structurally weak economy. Japan’s GDP has yet to recover to 2018 levels. Hence, the Trump Shock could set off a worse-than-expected result.

The Illusion of “Trump The Businessman”

Some Japanese policymakers and business executives contend that Trump will refrain from taking reckless steps because, as a businessman, he will do what’s good for the economy. This is wishful thinking.

Trump is motivated by what he thinks will enhance his long-term power and wealth. In his first term, governments and companies knew they could affect decisions by spending millions on events at his hotels.

The fact is that Trump has been able to increase his support even when his policies harm the very people he claims to be helping. Consider his 25% tariffs on some imports from China and his 25% steel tariffs on allies. They destroyed at least 200,000 factory jobs nationwide and barely created jobs, even in the Congressional districts where tariffs did the most to limit imports.

In some districts, his tariffs even reduced jobs. This was because the boosts to jobs in steel were more than offset by losses in steel-consuming industries like autos and appliances. Nonetheless, these tariffs gave Trump and the Republican Party sizeable gains in the 2020 Presidential election and 2022 Congressional elections.

Economist David Autor reports, “The combined predicted employment effect of import tariffs, retaliatory tariffs, and agricultural subsidies is small, ranging from a 0.2% loss to a 0.2% gain in the employment rate in most CZs [commuting zones, i.e., local labor markets].

Conversely, predicted Republican vote share gains are more sizable, reaching values of 0.5% to 1.0% for most CZs.” That was often the margin of victory. Despite any real accomplishment, many voters “appreciated the President’s intention to confront Chinese competition and protect US jobs.”

For years, Japanese leaders have preferred Republicans, seeing them as proponents of open trade. But that was only the stance of Republican donors.

Among voters, by contrast, a 2021 Gallup poll found that 51% of Republicans viewed imports as a threat, compared to just 18% of Democrats.

And yet, in pivotal “rust belt” states, enough Democrats see it that way that President Joe Biden maintained most of Trump’s tariffs and opposed Nippon Steel’s purchase of US Steel.

Trump’s Trade War

Tech stocks, including some Japanese producers of chip-making equipment, were roiled when Trump undercut America’s commitment to defending Taiwan, saying, “I wouldn’t feel so secure right now if I was them.” And yet, a blockade of Taiwan by China could bring the world economy to its knees.

Trump immediately linked his stance to trade issues. “They took almost 100% of our chip industry...Now we’re giving them [the Taiwan Semiconductor Manufacturing Corporation] billions of dollars to build new chips in our country, and then they’re going to take that too; in other words, they’ll build it, but then they’ll bring it back to their country.” There are not a lot of policy stances Trump genuinely believes in, but economic nationalism is one of them.

Trump’s new trade war, dwarfing his first-term actions, could disrupt global supply networks with incalculable effects. However, his new tariff notions would impact 16% of American GDP. What happens when an indispensable part becomes unavailable or its price suddenly doubles?

The world got a hint of it when Japan’s 2011 tsunami disrupted auto production worldwide. Forty-three. Moreover, 10% of the iPhone 15 Pro Max costs came from Japan, behind Korea at 29%. However, Trump would impose a 60% tariff on almost all of them because most are assembled in China.

In Trump’s first term, some Japanese trade officials told me they were relieved because China was the main target. This time around, Japan will suffer a lot more “collateral damage.” That’s because Japan’s exports to China hinge on China’s exports to the US. Over the last quarter century, there was a 50% correlation between the growth of Japan’s exports to China and Chinese GDP.

However, there was a much bigger correlation—75%—between Japan’s exports to China and China’s own exports to the US. The same is true for Korea and the Eurozone. There’s a 50% correlation in the growth of Japan’s exports and Korean GDP but a 74% correlation with Korea’s exports to the US (see chart below).

Trump Inflation Will Further Weaken Yen

The majority of economists believe that Trump’s policies will revive inflation, compelling the Federal Reserve to keep interest rates higher than it currently plans.

Economists differ on the size of the impact, but the widely respected Mark Zandi estimates that “Trump’s policies [will] add 1.2 percentage points to CPI inflation in 2025.” That’s a large number, given that the Fed’s inflation target is just 2%.

Higher interest rates weaken the yen as investors shift money from Japan to the US or other wealthy countries. A weaker yen, in turn, means falling real wages and, therefore, consumer spending.

According to the Japan Research Institute, a 10% depreciation in the yen over a year would result in a 5.7% hike in annual employee income at large manufacturers. That’s because it boosts their exports and profits.

By contrast, workers at second-tier services companies would see a decrease of 2.1%, while those at small and medium-sized enterprises face a drop of 1.9%. More than 70% of Japan’s employees work at SMEs.

Trumpian policies will spark inflation in three ways. First of all, Trump’s tariffs will raise prices by an amount equal to $1,700 per household. Secondly, Trump plans to extend parts of his 2017 tax cuts for the affluent, which are now set to expire at the end of 2025.

He also wants to reduce the corporate income tax—which he cut permanently in 2017 from 35% to 21%—to somewhere between 15% and 20%. These tax cuts will expand the annual US budget deficit by about $500 billion, or 2% of GDP. To hike the deficit when the country is already at full employment will raise prices. Finally, Trump wants to deport about 4 million illegal immigrants at a time of labor shortages, particularly in labor-intensive service sectors.

Reducing Fed Independence, Weakening the Dollar

Some Trump advisors have proposed even more reckless stances, but their enactment is uncertain. Some are trying to find ways to reduce the Fed’s independence by giving the President a say in interest rate policy and reducing the Fed’s power to regulate financial institutions.

It’s unclear whether he has the political and legal ability to do this. If it does happen, it would greatly reduce confidence in US monetary policy and add to volatility in financial markets.

Others are pushing for a weaker dollar, such as Vice Presidential candidate J.D. Vance and former U.S. Trade Representative Robert Lighthizer. The latter is now the trade chief of the Trumpian America First Policy Institute. Of course, as noted above, Trump’s fiscal and monetary policies would actually strengthen the dollar.

Still, these advisors advocate “retaliatory” tariffs if other countries fail to get their currencies to appreciate. Section 122 of the Trade Act of 1974 authorizes tariffs of up to 15% against countries that have “large and serious” trade surpluses with the U.S. In Trump’s first term, efforts in this direction by Lighthizer and trade advisor Peter Navarro were blocked by senior officials linked to Wall Street, such as Treasury Secretary Steven Mnuchin and former National Economic Council Chair Gary Cohn. There may be fewer such people in a second Trump term.

Spending At Trump Hotels Won’t Do the Trick

Prime Minister Shinzo Abe’s two summits with Trump were held at Trump’s Mar-a-Lago estate instead of Washington. Although Tokyo did not pay for the Japanese guests, this let Trump charge US taxpayers for most of the costs. None of this prevented Trump from including Japan in his steel tariffs.

At the time, Japanese officials called this a victory because it could have been worse; they weren’t treated like China. If there is a second term, Tokyo will get to see what “worse” looks like.