“Free Fall,” “Currency Crisis,” “Economic Collapse.” These are the alarmist terms being thrown about in light of the yen’s abrupt fall to ¥160/$.

The alarm intensified when currency intervention estimated at 1% of GDP failed to do more than arrest the weakening. As I write this, the yen stands at ¥157.8.

One normally cool-headed economist, Noah Smith, who has lived in Japan, epitomized the overreaction when he told his readers: “Japan’s currency isn’t in free fall yet, but it might be getting there... A Japanese economic collapse wouldn’t just impoverish the people of Japan; it would shake one of the pillars of the global economy...[It] would also alter the geopolitical balance of power in Asia, potentially bringing us closer to a major war.”

It reminds me of all the talk back in 2003 that Japan was on the brink of a calamitous crash in Japan Government Bonds (JGBs). Of course, that never happened and there is little evidence that is happening to the yen.

The bigger danger is not a sudden financial crash, but the continued corrosion of Japan’s international competitiveness and the living standard of much of the population.

For example, according to equity strategist Rie Nishihara Rie of JP Morgan, if the yen stays weaker than ¥157, the resulting rise in import prices could lift overall inflation enough to wipe out any gains in real wages this year.

In February, real (after-inflation) wages fell year-on-year for the 23rd consecutive month. How can the economy grow well if consumer purchasing power keeps falling?

No Free Fall

Where is the supposed free fall? To be sure, the yen did move from ¥155 to ¥160 in just two days. But that’s just because of pent-up demand by currency traders.

Since they did not know the “red line” that would cause the Finance Ministry to intervene, they had been moving cautiously. When the ¥/$ stayed weaker than ¥155 and the MOF still failed to move, they suddenly tested the ¥160 level.

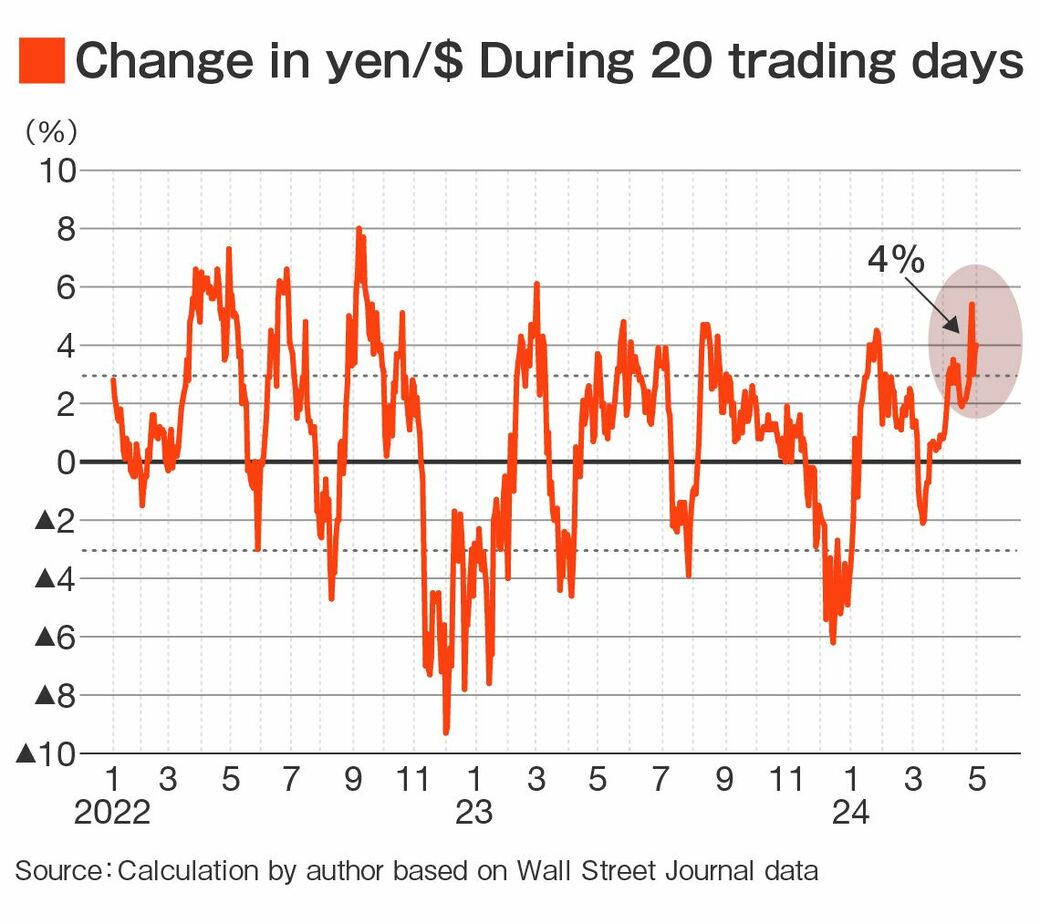

But a sudden ratchet is not an ongoing free fall. The chart below demonstrates this. The chart shows how much the yen’s value has risen or fallen during successive 20-day trading periods.

The recent spike is far lower than several previous ones in 2022 and early 2023. What we see in this chart is not free fall, but lots of volatility both up and down.

Even at ¥160/$, the yen’s value is more or less in line with economic fundamentals like the productivity of Japan’s exporters compared to those elsewhere and the gap between American and Japanese interest rates.

Japan Has The Power to Prevent Free Fall

Suppose the yen really was in a free fall that took it far away from the fundamentals. That is precisely the situation in which currency intervention can be effective, especially when it is coordinated with other countries.

Besides, Japan has plenty of ammunition to fight off any sort of currency panic. Even though it now runs a trade deficit most years, Japan still runs a surplus in a broader measure, the international current account.

That’s because it earns so much from its investments abroad, and those earnings keep growing. In 2023, net income on these investments totaled ¥34 trillion, i.e., 6% of GDP. Over the years through 2022, Japan has amassed ¥418 trillion in net international assets. That amount equals 75% of GDP. ¥162 trillion of those assets are currency reserves owned by the Bank of Japan.

If it looked like capital flight was beginning, Japan could use its currency reserves to shore up the yen. But it’s very unlikely it would need to do so.

The countries that have fallen victim to currency runs—as in the Asia currency crisis of 1998 or the Eurodebt crisis of 2010—were in the opposite position from Japan. They had run year after year of current account deficits and, as a result, were big international debtors.

While Japan can prevent a free fall, what it cannot do is prevent the steady weakening of the yen via currency intervention.

The yen is weak because Japan’s economy is weak, and its exporters are increasingly uncompetitive. So, intervention can mainly delay the inevitable for a little while or prevent markets from overreaching too far.

Why The Yen is So Weak

Many of Japan’s once-stellar Japanese industries are losing their ability to compete unless they drastically lower export prices (a weaker yen means lower prices in dollar terms on the export market). Beyond that, companies that remain competitive do so, in part, by moving much of their production offshore.

Japan’s automakers make 80% of their overseas sales by producing overseas rather than exporting from Japan. As a result, it now takes a bigger drop in the yen’s value to produce the same boost to exports as in the past.

As of March, the real effective value of the yen vis-à-vis all of Japan’s trading patterns was 40% below its average purchasing power over the 1970-2024 period. This is calculated by adjusting the nominal yen for different rates of inflation/deflation among the countries.

In simpler terms, when Japan exports a million cars today, it can only buy 40% as much oil, wheat, or TVs as a million cars brought it in the past.

And yet the cheap yen did not bring Japan the export boom it had expected. On the contrary, it ran a trade deficit in ten of the last thirteen years.

By contrast, Japan had run a trade surplus every single year from 1994 to 2010, even though the real yen was far stronger back then. Its products were so innovative and of such high quality that they could command premium prices.

That’s the long-term picture. In the shorter term, the main factor shaping the value of the yen is the gap between American and Japanese interest rates. The bigger the rate gap, the more that investors move money from Japan to the US and other countries.

To do that, they have to sell yen, which lowers its value. In the last three years, the ups and downs of the interest rate gap can explain about 94% of the ups and downs of the ¥/$ value.

Relatively small surprises can often create big and abrupt shifts in financial markets. Just a few months ago, investors expected the US Federal Reserve to cut interest rates three times this year and the BOJ to tighten further. That would have narrowed the rate gap.

But US inflation has been so stubborn that the Fed may not cut rates at all, and some traders fear it may even raise rates a bit. Meanwhile, on April 26, the BOJ announced that it would not reduce the pace of JGB purchases, as many investors had expected.

Consequently, long-term interest rates in Japan will be higher than expected. Put it all together and the rate gap is going to be much bigger than investors thought just a little while ago. The combination sent the yen tumbling on April 26th and 29th. The big risk today is not a free fall. It’s that, by blaming everything on “speculators,” the Ministry of Finance could lead people to lose sight of the underlying root causes.