The tombstone of China’s economic miracle will read “premature death caused by Xi Jinping.” All high-growth countries slow down as they get richer.

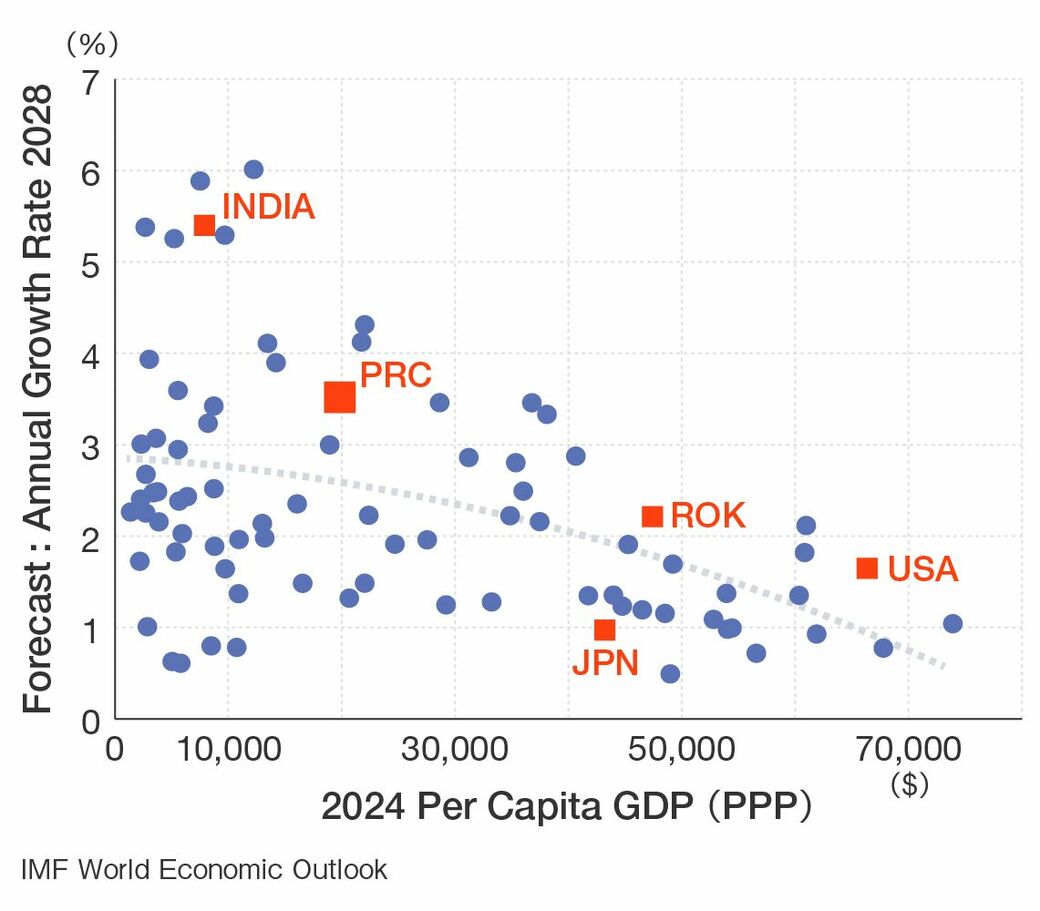

However, sacrificing growth to political goals is why the International Monetary Fund (IMF) foresees China’s growth tumbling toward just 3.7% by 2028, just 11th among all countries. A financial crash—which economists are not good at predicting—would lower medium-term growth even more. At turning points like this, forecasts are hard.

The root cause of the property bubble is that the wage share of national income is way too low, and therefore so is consumption. For years, China devoted up to a uniquely high 45% of its GDP to investment.

However, as it developed, the need for so much investment declined, and it needed to shift to more consumption. Chinese leaders recognized this but never implemented the shift. Instead, it started building “apartments for no one” akin to Japan’s “bridges to nowhere,” and built up debt in the process.

The Rise and Fall Of Private Companies

As in Japan, the property bubble is just part of a more fundamental problems. When Mao Zedong died in 1976, he left China the second poorest among 140 countries. In response, Deng Xiaoping sought and accepted advice from Japanese and Singaporean advisors and created “socialism with Japanese and Singaporean characteristics.” Xi’s abandonment of that recipe is China’s biggest problem.

One indispensable ingredient was Japan-style industrial policy, which combined state promotion of modern industries with reliance on the efficiency of private companies operating in competition. By 2018, state-owned enterprises (SOEs), the only legal companies under Mao, accounted for just 12% of urban employment and exports and only one-third of business investment.

SOEs never could have created the economic miracle. Nearly half of them regularly run losses, thus causing the economy to shrink. Even profitable SOEs create less growth than private companies for every yuan they invest.

Xi is resurrecting SOE dominance. In 2012, before Xi ascended, only 32% of bank loans went to SOEs. By 2016, SOEs had 83%. Why did Xi do this? Because the Chinese Communist Party (CCP) worries that private companies could become a separate locus of power.

Driving Away Foreign Firms

Equally indispensable is the role of foreign companies in transferring technology and driving exports. As in Japan, exports had to lead to industrialization because China’s people were still too poor to buy modern factory goods. Unfortunately, China could not yet compete in the global market. Singapore provided the solution: bring foreign companies to China to make and export their products.

By 2000, foreign multinationals produced half of China’s exports, especially high-tech items. Foreign companies exported 100% of computer products, compared to 40% of clothing.

This process transferred know-how to all the new private companies that supplied 80% of the content of these exports, and even to unrelated firms.

While Xi does not want to isolate China, he believes China would be more secure if it were less dependent on foreign technology and firms. He also believes China no longer needs foreign technology as much as before.

He is miscalculating. In 2015, he launched a “Made in China 2025” program aimed at China achieving global supremacy in several pivotal technologies and products. The program has fallen short.

For example, China’s tax breaks for companies issuing lots of patents caused them to shift from high-quality patents to lower-quality ones.

That actually reduced innovation and company productivity, according to Chinese academics. While no one doubts that China has made tremendous strides in some technologies, driving away foreign firms hurts innovation and growth.

For years, foreign firms have suffered discrimination in procurement, theft of intellectual property, arrests of foreign personnel, including 17 Japanese employees, on dubious charges of espionage, and now demands that foreign firms give CCP representatives in their companies a say in management decisions.

With sales in China slowing down, companies are less willing to tolerate such practices. Foreign Direct Investment (FDI) into China from all countries plunged by 8% in the first eight months of this year.

The Consequences

The clampdown on private and foreign companies couldn’t come at a worse time. With the labor force shrinking and private investment decelerating, China cannot grow unless it gets more output from those labor and capital inputs.

That measure of efficiency is called Total Factor Productivity (TFP). During 1980-2010, TFP accounted for about 40% of growth in GDP per worker. However, the TFP growth rate has plunged by two-thirds under Xi. That’s one of the biggest reasons for the drop in per capita GDP growth.

Impact on Japan

China and other rich countries have become so interdependent that what hurts China will hurt the rest and vice versa. Economists cited by Reuters say China’s travails “could knock 1-2 percentage points off Japan's annual growth.” The biggest reason is that Japanese exports to China add up to almost 4% of GDP (not counting the imported energy and supplies used to make those products).

Already, in the first eight months of this year, Japan’s exports are down about 10% from last year. If the downturn grows bigger and lasts longer, that could be a big hit. On top of that, every 1 percentage point drop in China’s growth cuts growth in the rest of East Asia by about 0.3%. That cuts their own imports from Japan.

If China suffers a financial crash, that would hurt Japan mostly by hurting exports rather than financial contagion. That was the case in the 2008-09 global financial meltdown.

Aside from the auto industry, most Japanese companies reach their customers in China via exports, not operating inside China. Still, all who operate there are vulnerable to corporate espionage and other problems.

Is it worth the risk when many companies expect their sales growth in China to lag behind sales elsewhere? No wonder that only 20% of Japanese companies now plan to expand their operations in the next few years, a lower share than in any other of the 18 targets except Hong Kong and Russia. Another 5.5% of firms plan to reduce their operations. Most will keep their current level or are uncertain.

Besides all this, China is using technology to back up its bellicose geopolitical ambitions. So, the Kishida administration has joined the US and Europe in what they call “de-risking.” That means cutting off exports of certain critical technologies to China, like advanced chipmaking equipment.

China, in turn, is restricting the export of critical minerals to Japan and other countries, either in retaliation or for unrelated political reasons. To avoid economic coercion, Japan has joined others in diversifying sources of critical supplies, even if that raises costs.

Neither China nor the rest of the world wants a drastic decoupling of ordinary trade and investment. These countries are so interdependent that the IMF has predicted that a big drop in trade with China could reduce global GDP by as much as 7%. That’s twice as bad as during Covid.

Still, countries miscalculate, and actions and reactions can take on a life of their own. That’s a huge risk. There is another. China has become a destabilizing force now that is strong and confident. Could it become an even bigger problem if a weak economy creates social instability?