At ¥145/$, the yen has weakened so much that, once again, the Finance Ministry (MOF) is threatening to intervene in currency markets to shore up its value. If it does, it is bound to fail, just as it failed last fall despite spending a stupendous ¥9.15 trillion ($63 billion), almost 2% of GDP.

Intervention only works when a currency is out of line with economic fundamentals, but that is not the case today. The yen is weak because Japan’s economy is weak.

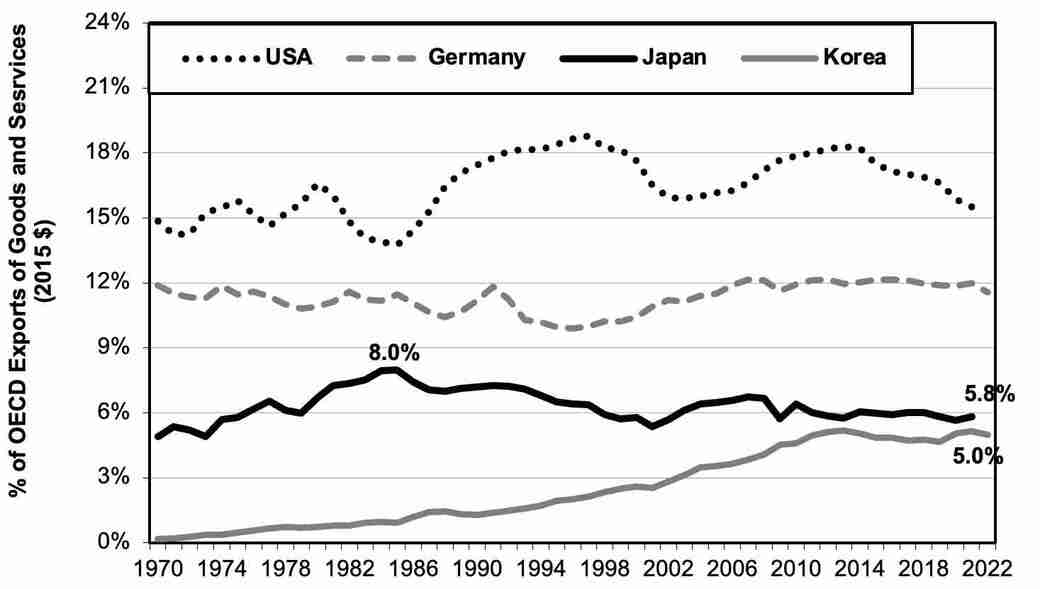

Japan’s leading exporters have lost their past competitiveness. In fact, Japan’s share of rich country exports has fallen so much that, if current trends continue, Korea may soon overtake Japan in the volume of exports.

A strong yen translates into high prices in export markets; a weak yen means low prices. A few decades back, Japan’s consumer electronics, industrial machinery, and automobiles were so clearly superior that Japan’s exporters could command high prices and still enjoy a high share of global exports.

Today, however, these companies have lost much of their luster. To sell their products, they must lower their prices, which requires a weaker yen.

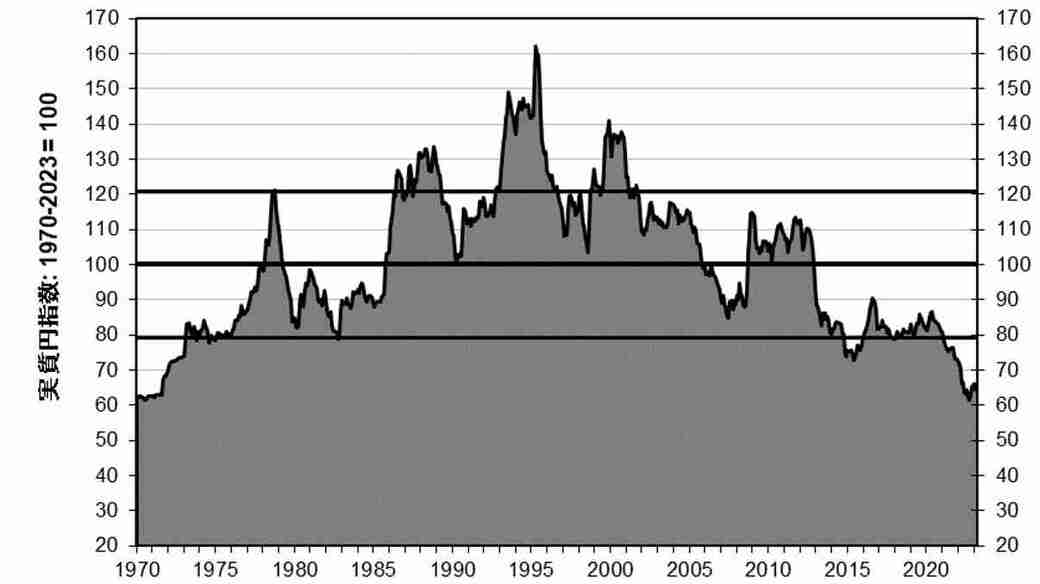

In fact, the “real effective yen” is the weakest it has been in a half-century. That measure takes into account the difference in price trends between Japan and all of its trading partners. As a result, the real effective yen indicates how the prices of Japanese products in foreign markets compare to those of competitors (see chart below).

¥145/$ And The Interest Rate Gap

To understand why the yen is so weak and the MOF so helpless to counter this, we need to look at both medium-term and long-term determinants.

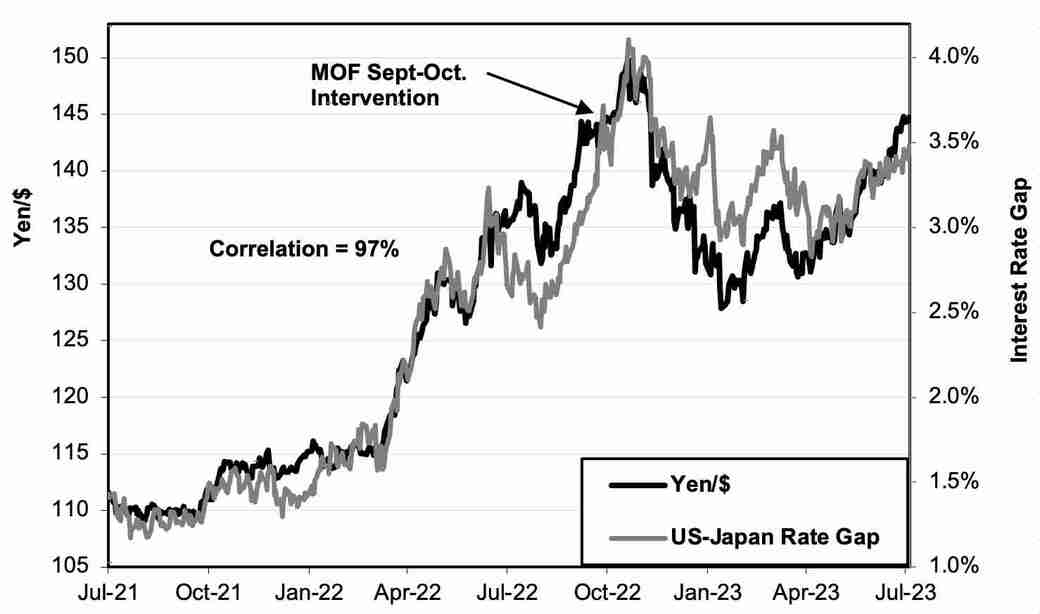

Over the last two years, the main factor in the yen’s value has been the gap between 10-year government bond rates in the US and Japan. The bigger the gap, the weaker the yen. That’s because, when US bonds pay much more than JGBs, investor money leaves Japan to go to the US. For that to happen, investors have to sell yen, which lowers its value via the law of supply and demand.

In fact, since July 2021, there has been a stunningly high 97% correlation between daily ups and downs in the rate gap and daily moves in the ¥/$ rate. Today, the interest rate gap is about 3.5%, and ¥145/$ is in line with that gap. MOF intervention last September-October did not even put a dent in that linkage (see chart below).

US rates fell earlier this year because investors thought the US economy would go into recession this year and the Fed would have to lower rates. Because the US economy has been surprisingly resilient, investors now expect high rates in the US to last, or go even higher, for the rest of this year. Meanwhile, new BOJ Governor Kazuo Ueda has failed to raise interest rates as investors expected earlier in the year. All of this portends a weak yen no matter what the MOF does.

This, however, is just the beginning of the story. If the interest rate gap were the sole cause of the weak yen, the Bank of Japan (BOJ) could help the yen recover just by letting interest rates rise.

In reality, no matter what the BOJ does, the yen is not likely to return to levels deemed normal a decade or two ago. In fact, the statistics show that, for any given rate gap, the ¥/$ is likely is like to be 20 points weaker than it was back in 2001-13. To understand why, we need to look at the long-term picture.

Japanese Exporters Need An Ever-Weaker Yen to Sell Their Goods

Even with a cheap yen, Japanese companies have trouble competing, and that means ongoing pressure for the yen to keep getting weaker, as we saw in the top chart. Let’s look at the evidence.

For the 30 years from 1980 through 2010, whether the yen was strong or weak, Japan ran trade surpluses every year but one. Since 2011, however, Japan has suffered trade deficits in nine of the last twelve years, even though the real yen is 25% cheaper than it was during 1980-2010.

Japan’s share of real (price-adjusted) exports by OECD countries peaked at 8% back in 1985, when the “real effective yen” was 22% stronger than today. Since then, Japan’s share has steadily fallen. By 2021, despite a much weaker yen, Japan’s export share was down to just 5.8%. By contrast, both the US and Germany maintained their share, and, if current trends continue, Korea soon surpass Japan, as seen in the chart below.

Back in 2000, Japan’s electronics companies enjoyed a trade surplus equal to a hefty 1.3% of GDP. Now the sector regularly runs trade deficits. Moreover, these companies have trouble competing, whether they produce in Japan or overseas. From 2010 to 2020, despite an explosion in global demand for electronics, Japanese electronics firms’ global sales plunged by 30%.

In autos, Japan will soon be overtaken by China as the world’s top exporter, partly because Japanese companies lag in ever-more-popular battery-powered electric vehicles. With exports accounting for half of all cars made in Japan, a drop in export market share would be a significant hit to the economy.

Beyond that, Japanese automakers are also losing market share in countries where they produce, like China and Europe. 40% of Americans who bought Teslas had switched from Japanese brands.

The auto case brings up another reason a weak yen has not helped Japan’s export as much as policymakers had hoped. Japan’s automakers make 80% of their overseas sales by producing overseas rather than exporting from Japan.

The same pattern is seen in other key products, from electronics to all sorts of machinery. The more that Japanese firms move their production overseas, the smaller the boost to exports for any given drop in the value of the yen.

Weak Yen: Less Benefit vs. Higher Cost

In economics, everything that has a benefit also has a cost. What matters is whether the benefit is greater than the cost. A weak yen means that Japanese households and producers have to pay more for foodstuffs and energy. That transfers income from Japan to foreign producers.

Higher import prices in food and energy are the biggest reason for today’s rising inflation and falling real wages. Lower wages leave consumers with less money to buy made-in-Japan products. As a result, real (price-adjusted) household spending in 2023 is no higher than it was way back in 2012.

Japan is having to pay a higher cost for even less benefit in terms of improved exports. Today’s weak yen doesn’t just reflect economic weakness; it also makes a weak economy even shakier.