If the Daiwa Institute of Research (DIR) is correct, Trump’s trade war will reduce Japan’s real GDP this year by 0.6% from what it would have been, and, in 2029, by 2.9% compared to what it would have been.

If so, then the Trump tariffs will erase three-quarters of the growth that the IMF had predicted for Japan over the coming five years. DIR includes not only the impact of Trump’s tariffs on Japan, but also the indirect impact of Trump’s tariffs in reducing growth in China and other purchasers of Japan’s exports.

To get a sense of Trump’s mindset, consider how much harm Trump is inflicting on America itself, according to a forecast from Japan’s Institute of Developing Economies (IDE).

In a report released before the April 2nd announcement, the IDE projected that the Trump tariffs on autos, steel, China, etc., would subtract 2.7% from America’s own GDP in 2027. That’s a recession-sized drop. Due to the April 2 tariff hikes, JP Morgan has already raised to 60% the likelihood of a recession in the next 12 months.

Moreover, expectations for medium-term growth are also likely to fall. Trump has turned MAGA into MAGSA (Make America Grow Slowly Again).

There is so much uncertainty about the future that none of these forecasts should be taken too seriously, but they show the order of magnitude of the damage if these tariffs are maintained and if the trade war worsens. China’s announcement of 34% tariffs on all US imports shows the growing danger. Not since the early 1930s has the world experienced anything like this.

This is a particular danger for Japan. Its real GDP in 2024 was only 0.5% above the level way back in 2018, and Trump’s trade war is likely to extend this stagnation.

Not Much Method In Trump’s Madness

These actions should shatter any remaining illusions in Tokyo that Trump is a rational businessman who will do what is good for the US economy. On the contrary, Trump is too blinded by his nationalistic ideology to see how self-destructive his actions are.

He is a bumbler. To take just one example, he fired the government’s bird scientists at a time when bird flu makes it hard to find eggs in the store.

His goal is to reduce America’s trade deficit—now at 4.5% of GDP—to zero. But this cannot be done without triggering a severe recession. Trump deludes himself that the only reason America runs a trade deficit is that other nations are cheating.

However, the real reason is that America’s total consumption—consumer spending, business investment, and government spending—is chronically larger than GDP. So, reducing that consumption is the only way to reduce the deficit substantially.

That’s why America’s deficits have declined most when GDP grew slowly or even fell. The biggest multi-year drop in the trade deficit came in the Great Recession years of 2007-2009. Unemployment rose to 10%. Even then, the deficit shrank by “only” 2.3% of GDP—half the shrinkage that Trump is now trying to achieve.

Now, Tokyo has to figure out how to respond. Traditionally, Japan is very reluctant to retaliate like China, Canada, or the EU. However, Prime Minister Shigeru Ishiba’s “placate Trump” strategy has utterly failed. It’s a difficult dilemma and will undoubtedly be a significant factor in this summer’s Upper House elections.

Dollar Sinks A Bit Vis-À-Vis Yen

The dollar has dropped a bit since Trump’s April 2 announcement, but not enough to make a dent in the deficit. The dollar's value also depends on how much growth investors expect in US GDP and corporate profits, and thus their expectations for stock prices.

If international investors now expect slower growth in the US in the medium term and a recession in the short term, they will send less money to the US stock market. That means they need to purchase fewer dollars.

In fact, according to the Wall Street Journal, over a five-year period, there has been a high 70% correlation between the value of the dollar vis-à-vis the Euro and the difference between returns to shareholders on the US and German stock markets.

Nonetheless, the dollar’s 2% vis-à-vis the yen is a small drop. That’s just the initial reaction in a market shocked by the severity of Trump’s actions. It will take a while to see what evolves in the currency markets.

The Hit To Japan’s Exports and GDP Growth

A few trends will show why the trade war will cause such severe harm to Japan.

Firstly, Japan’s exports are far less competitive than they used to be, and a 24% tariff rate will make them even less competitive. Consider this. The yen has depreciated 27% in recent years, from ¥110 in 2018 to ¥151 in 2024. Policymakers believed this hefty a price drop would boost GDP growth by increasing Japan’s trade surplus. No such thing happened.

In constant prices, exports increased no faster than imports, so the real trade surplus barely moved. On the other hand, import prices rose even more sharply than export prices, and so, in nominal terms, the trade deficit worsened. Japan got the worst of both worlds: paying more for imports while failing to get any boost to growth from exports. Now, Trump’s trade war will reduce Japan’s real surplus and thus GDP growth.

Japan’s auto sector is particularly vulnerable. But what Trump misses is that so are the Big Detroit Three. Japan’s auto exports to the US account for almost 30% of Japan’s exports to the US and 20% of its total global exports.

However, Trump’s tariffs are predicted to hike the price of new cars by thousands of dollars. And that will cause even more people to buy fewer new autos. Already, in 2024, people bought 39 million used cars and light trucks (like SUVs and pickups) and just 15.6 million new autos.

That’s because prices have risen so much. 44% of all new vehicles cost more than $50,000, and only 13% cost less than $36,000. All of the Detroit Three have stopped even producing a mid-size sedan to compete with Toyota’s Camry.

Rather, they are focusing on those who can afford expensive SUVs and pickup trucks. The top fifth of American households, with an average annual income of $265,000, accounted for 55% of expenditures on new vehicles last year, up from 40% in 2020, And the second most affluent 20% accounted for another 22%.

A price hike of several thousand dollars will not only cause even more potential buyers in the bottom 60% to switch to used cars, but also more of those in the top 40 to either buy used cars or less expensive new cars, including the types that Detroit has abandoned. What will that do to automotive jobs?

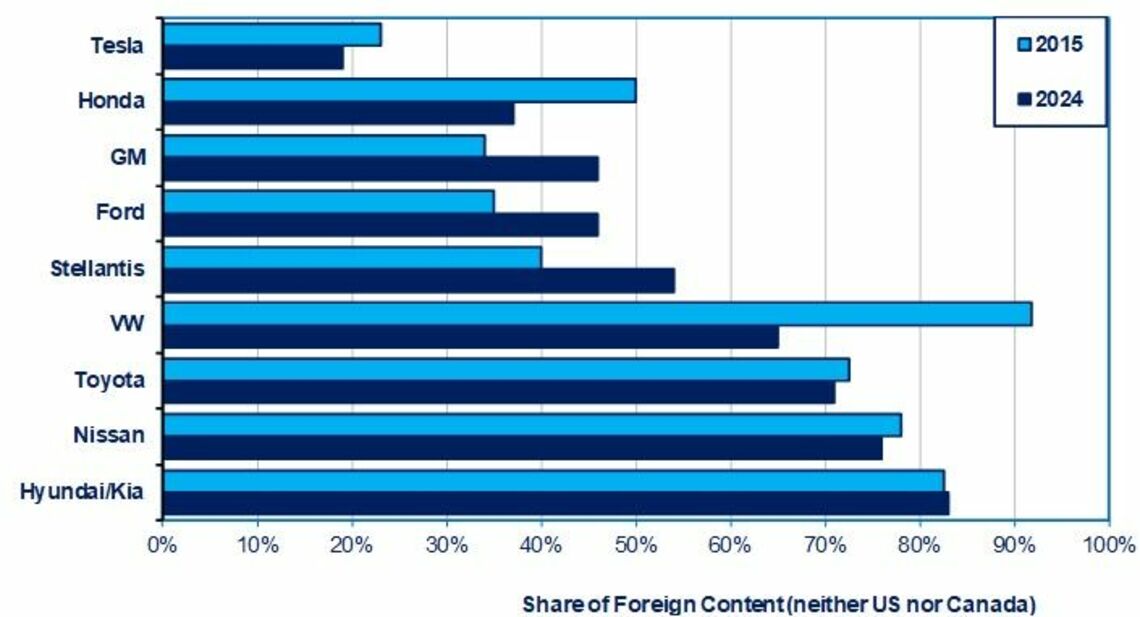

In another case of his bumbling, Trump says he doesn’t care if car prices rise because customers will switch to American models. If he had any curiosity, he would know that around half of all the content in a US-branded car comes from outside the US and Canada. (The US and Canada supply chains are so intertwined that US government figures call “domestic content” the combined value of American and Canadian inputs.)

He would also know that it takes years to switch delicate supply chains. So, yes, except for Honda, the Detroit brands have less foreign content, but their prices will still rise by thousands of dollars per car.

How Tariffs on China and the Rest of Asia Will Hurt Japan

Finally, let’s examine how Trump’s 54% tariffs on China and 25% on Korea and big hikes in the rest of East Asia will hurt Japan. The more that China and Korea export to the US, the more Japan can export to them.

That’s because so much of Japan’s exports serve as input to manufacturing exports in those two countries, like the Japanese computer chips inside smartphones assembled in China. There is a 75% correlation between Japan’s exports to China and China’s own exports to the US. However, there is a much smaller correlation--only a 50%-- between Japan’s exports to China and China’s GDP growth.

A similar pattern exists with Korea and other East Asian countries. Even more interesting, Japan’s exports to Korea depend heavily on China’s exports to the US. The correlation is 50%. This is the delicate interdependence that Trump’s trade war endangers.

Trump is wreaking havoc on the global economy and America’s as well, and trying to force the rest of the world to accept it. Whom the gods would destroy, they first make mad.